Foundation & Endowment Services

Many of our clients have philanthropic inclinations, giving significantly of their time and their wealth. Some use trusts and estate planning techniques to achieve their giving objectives, while others form private foundations to support their charitable objectives during their lifetimes. Many of our clients also participate on the boards of not-for-profit organizations with substantial endowment funds.

In alignment with our client’s participation with charitable organizations, Perkins Coie Trust Company also delivers services to private foundations and endowment funds. These services include:

- Investment management – support in development of investment policy and spending strategy, portfolio construction and performance monitoring

- Administrative support – custodial and recordkeeping services, gift and grant processing, and coordination with accountants on tax returns and audits

- Legal services – donor gifting strategies, board governance and legal compliance counseling, and assistance with IRS rulings

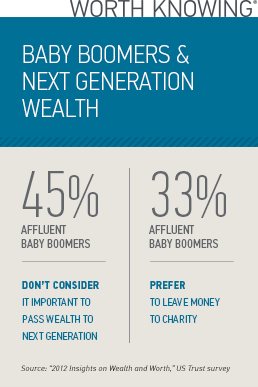

Wealth transferred through the year 2045 is projected to total $84.4 trillion $72.6 trillion in assets transferred to heirs and $11.9 trillion donated to charities.

According to the research, grantor trusts (77%) are far and away the most common means of increasing the tax-efficiency of wealth transfer events among high-net-worth practices, followed by spousal lifetime access trusts (54%) and strategic gifting (46%).

Source: Cerulli Associates